In today’s turbulent and ever-changing business landscape, there’s no excuse for not investing in business continuity management (BCM). Having already looked at the concept in my last post, let’s take a closer look at how to put BCM into practice. After all, the proof of the pudding is in the eating.

To recap just a little, the discipline of business continuity management requires a holistic approach that balances threats and vulnerabilities with opportunities. We all intuitively strive to achieve this balance on many different levels every day.

Finding the right balance in a complex business environment, however, requires profound analysis and expert judgment more than individual risk perception, which relies on our wildly different appetites for risk. The human impulse to take a chance and hope for the best might turn out fine in the short run, but blindly gambling on the future of your business isn’t the smartest move.

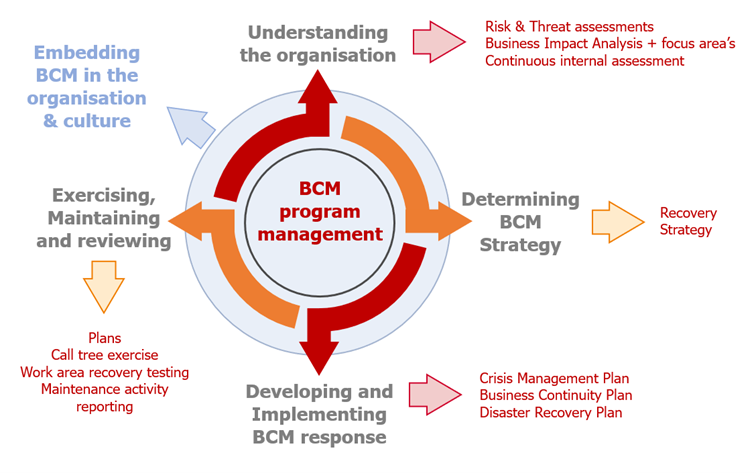

Circular model

The systematic approach to installing a business continuity management system (BCMS) can be broken down into the following steps, applied in a circular model:

- Perform a deep analysis of vulnerabilities, threats, and possible impacts to your core business, or of your organisation itself, taking account of its actual functioning and the importance of your core business in a broad context.

- Determine a continuity strategy, based on the assumption that disruption will happen sooner or later, and define your recovery goals.

- In addition to protective measures, develop and implement response capabilities to meet your goals, such as a crisis management structure, a disaster recovery plan, or a business continuity plan.

- Check the effectiveness of your measures and plans through tests and exercises and apply continuous improvements based on the results.

- Embed business continuity in your organisation’s culture.

Incremental implementation

That’s quite the workload! But don’t let that put you off. The circular model allows for an incremental implementation at a pace that your business can cope with.

Moreover, the added value lies not only in the final result. The process of creation and implementation itself, in which various team members should actively participate, also contributes a lot to organisational resilience. Because the implementation process crosses departmental boundaries and requires collaboration, it helps to broaden everyone’s perspective.

Opportunities for improvement

The same goes for tests and exercises. They are as much a reward for your efforts so far as they are an opportunity to identify possible areas for improvement. And these areas for improvement can arise due to many reasons, such as a growing organisation, a changing risk profile, the introduction of new technology, evolving stakeholder expectations, and so on.

To conclude, continuity exercises should be designed and conducted to:

- provide reassurance that your response plans provide adequate recovery capability,

- keep your recovery skills and competencies at the required level to successfully execute responses,

- highlight the strengths and weaknesses of your response plans and apply continuous improvement,

- embed a business continuity approach in your organisation’s culture by inviting a diverse group of people to contribute to creating and improving your response capabilities.

Interested in how a BCMS implementation would work in your business environment? Or are you ready to take the next step with your existing BCMS through continuity testing or exercises? Our enthusiastic and experienced specialists are ready to support and guide you on your journey. Don’t hesitate to contact us